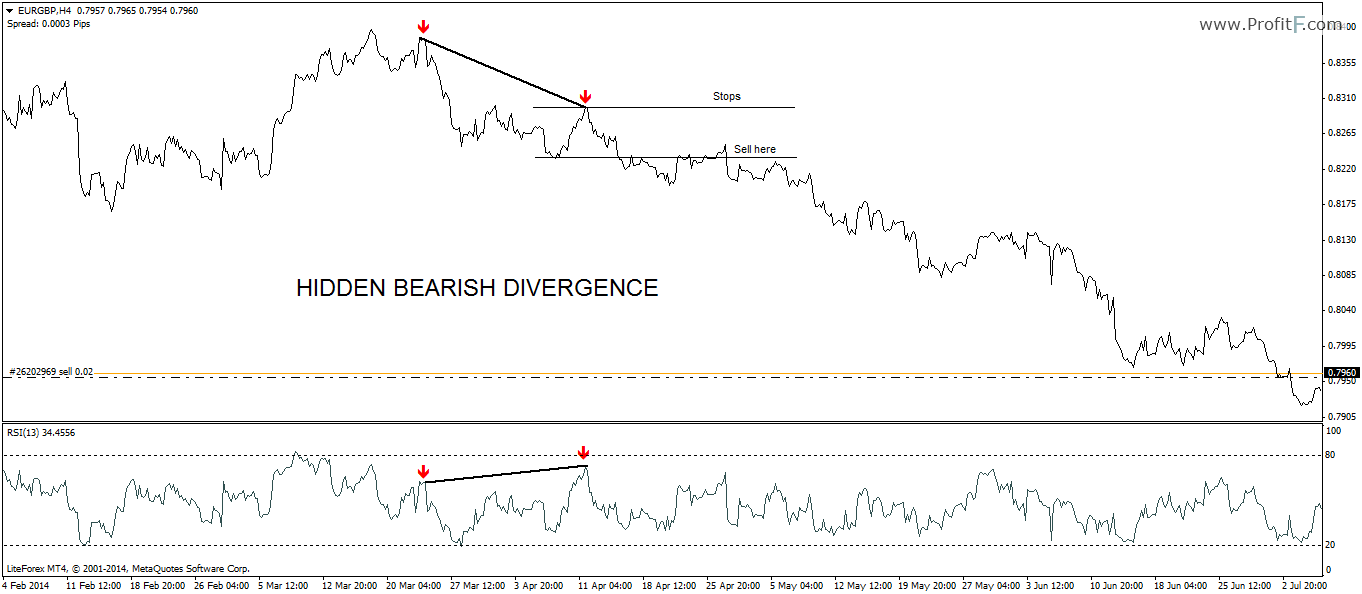

img width="391" src=" "><p>Investing in the stock market can be an exhilarating yet nerve-wracking experience. As market participants, we constantly strive to uncover the next big trend or trading opportunity. One valuable tool that has stood the test of time is the Relative Strength Index (RSI). This widely-used technical indicator allows us to gauge the strength and momentum of a security, helping us make more informed investment decisions.</p><p>Within the realm of RSI lies an intriguing concept known as RSI divergence. This phenomenon occurs when the price of an asset moves in one direction, while the RSI moves in the opposite direction. Bullish divergence arises when the price makes lower lows, but the RSI makes higher lows ? signaling a potential reversal to the upside. On the other hand, bearish divergence occurs when the price makes higher highs, but the RSI makes lower highs ? indicating a possible trend reversal to the downside. Understanding and recognizing these divergences can prove to be a valuable asset in navigating the complex landscape of the markets.</p><p>Now, let us take a deep dive into the world of RSI divergence, dissecting its intricacies and unlocking its potential for identifying bullish and bearish trends. By studying historical charts and real-world examples, we aim to equip you with the knowledge and skills to harness the power of RSI divergence in your trading endeavors. So, buckle up as we embark on this enlightening journey through the world of Relative Strength Index divergence and its impact on bullish and bearish trends.</p><iframe src="https://www.youtube.com/embed/5nM_wypL6YI" width="560" height="315" frameborder="0" allowfullscreen></iframe><h3 id="understanding-rsi-divergence">Understanding RSI Divergence</h3><p>The concept of RSI divergence is a powerful tool in technical analysis that can help traders identify potential bullish and bearish trends. RSI, or Relative Strength Index, is a popular momentum oscillator used to measure the speed and change of price movements. By analyzing RSI divergence, traders can gain insights into the strength and direction of a trend, which can be invaluable in making informed trading decisions.</p><p>When we talk about RSI divergence, we are referring to a situation where the price of a security moves in one direction, while the RSI indicator moves in the opposite direction. This discrepancy between price and RSI can often serve as an early warning sign of a potential trend reversal or continuation.</p><p>In bullish trends, we look for bullish RSI divergence. This occurs when the price of a security makes a lower low, but the RSI indicator makes a higher low. This suggests that while the price may be weakening, the underlying strength indicated by RSI is increasing, signaling a possible upcoming price reversal to the upside.</p><p>Conversely, in bearish trends, we look for bearish RSI divergence. This occurs when the price of a security makes a higher high, but the RSI indicator makes a lower high. This indicates that while the price may be rising, the underlying strength indicated by RSI is decreasing, suggesting a potential upcoming price reversal to the downside.</p><p>By understanding and recognizing RSI divergence, traders can take advantage of these patterns to enter or exit trades at optimal levels, increasing their potential for profits. However, it is important to note that RSI divergence should not be used as the sole basis for trading decisions and should be used in conjunction with other technical analysis tools for confirmation.</p><p>In conclusion, RSI divergence is a powerful concept that can provide valuable insights into potential bullish and bearish trends. By recognizing and interpreting RSI divergence correctly, traders can enhance their decision-making process and improve their overall trading performance.</p><h3 id="identifying-bullish-trends">Identifying Bullish Trends</h3><p>In order to identify bullish trends, one valuable tool that traders can utilize is RSI divergence. https://www.youtube.com/watch?v=5nM_wypL6YI&t=2s&ab_channel=ArtofForexTrading%21 (RSI) is a widely used indicator that provides insights into the strength and momentum of a particular asset's price movement. By analyzing the RSI, traders can identify potential bullish trends and make informed trading decisions.</p><p>When it comes to RSI divergence, one key aspect to consider is the relationship between the RSI and the price of an asset. During bullish trends, the RSI usually displays a pattern of higher lows, indicating increasing strength and positive momentum. Traders can watch for this divergence between the RSI and price to confirm bullish trends and look for opportunities to enter or stay in a trade.</p><p>Another important factor to consider when identifying bullish trends is the RSI's overbought and oversold levels. The RSI typically ranges from 0 to 100, with readings above 70 signaling overbought conditions and readings below 30 indicating oversold conditions. During bullish trends, the RSI may consistently stay above the oversold level of 30, further confirming the strength of the upward price movement.</p><p>By paying close attention to RSI divergence and the relationship between the RSI and price, traders can effectively identify and capitalize on bullish trends in the market. However, it's essential to note that RSI divergence should not be used as the sole indicator for making trading decisions. It is always recommended to combine it with other technical analysis tools and indicators for a more comprehensive view of market trends.</p><h3 id="spotting-bearish-trends">Spotting Bearish Trends</h3><p>In the world of financial markets, being able to spot bearish trends is crucial for savvy traders. Market participants strive to identify signals that signal a potential downward trend in prices. One powerful tool that can aid in this process is RSI divergence.</p><p>RSI divergence, or Relative Strength Index divergence, occurs when the price of an asset moves in the opposite direction of the RSI indicator. This can indicate a weakening trend and potentially foreshadow a bearish reversal. Traders who are vigilant in monitoring RSI divergence can gain valuable insights into the market sentiment.</p><p>The Relative Strength Index (RSI) is a widely used technical indicator that measures the strength and momentum of a price trend. When the RSI diverges from the price action, it suggests a potential shift in sentiment. This can be observed when the price of an asset continues to rise while the RSI starts to decline, signaling a bearish divergence.</p><p>By paying attention to this bearish RSI divergence, traders can gain insight into potential future price movements. It is important to note that RSI divergence alone should not be the sole basis for making trading decisions. However, when combined with other technical analysis tools and market context, it can provide valuable information to traders.</p><p>In conclusion, spotting bearish trends is a skill that traders should strive to master. RSI divergence is an effective tool in this quest, as it can provide early indications of potential bearish reversals. By incorporating RSI divergence analysis into their trading strategies, market participants can enhance their decision-making process and potentially capitalize on downward price movements.</p>

"><p>Investing in the stock market can be an exhilarating yet nerve-wracking experience. As market participants, we constantly strive to uncover the next big trend or trading opportunity. One valuable tool that has stood the test of time is the Relative Strength Index (RSI). This widely-used technical indicator allows us to gauge the strength and momentum of a security, helping us make more informed investment decisions.</p><p>Within the realm of RSI lies an intriguing concept known as RSI divergence. This phenomenon occurs when the price of an asset moves in one direction, while the RSI moves in the opposite direction. Bullish divergence arises when the price makes lower lows, but the RSI makes higher lows ? signaling a potential reversal to the upside. On the other hand, bearish divergence occurs when the price makes higher highs, but the RSI makes lower highs ? indicating a possible trend reversal to the downside. Understanding and recognizing these divergences can prove to be a valuable asset in navigating the complex landscape of the markets.</p><p>Now, let us take a deep dive into the world of RSI divergence, dissecting its intricacies and unlocking its potential for identifying bullish and bearish trends. By studying historical charts and real-world examples, we aim to equip you with the knowledge and skills to harness the power of RSI divergence in your trading endeavors. So, buckle up as we embark on this enlightening journey through the world of Relative Strength Index divergence and its impact on bullish and bearish trends.</p><iframe src="https://www.youtube.com/embed/5nM_wypL6YI" width="560" height="315" frameborder="0" allowfullscreen></iframe><h3 id="understanding-rsi-divergence">Understanding RSI Divergence</h3><p>The concept of RSI divergence is a powerful tool in technical analysis that can help traders identify potential bullish and bearish trends. RSI, or Relative Strength Index, is a popular momentum oscillator used to measure the speed and change of price movements. By analyzing RSI divergence, traders can gain insights into the strength and direction of a trend, which can be invaluable in making informed trading decisions.</p><p>When we talk about RSI divergence, we are referring to a situation where the price of a security moves in one direction, while the RSI indicator moves in the opposite direction. This discrepancy between price and RSI can often serve as an early warning sign of a potential trend reversal or continuation.</p><p>In bullish trends, we look for bullish RSI divergence. This occurs when the price of a security makes a lower low, but the RSI indicator makes a higher low. This suggests that while the price may be weakening, the underlying strength indicated by RSI is increasing, signaling a possible upcoming price reversal to the upside.</p><p>Conversely, in bearish trends, we look for bearish RSI divergence. This occurs when the price of a security makes a higher high, but the RSI indicator makes a lower high. This indicates that while the price may be rising, the underlying strength indicated by RSI is decreasing, suggesting a potential upcoming price reversal to the downside.</p><p>By understanding and recognizing RSI divergence, traders can take advantage of these patterns to enter or exit trades at optimal levels, increasing their potential for profits. However, it is important to note that RSI divergence should not be used as the sole basis for trading decisions and should be used in conjunction with other technical analysis tools for confirmation.</p><p>In conclusion, RSI divergence is a powerful concept that can provide valuable insights into potential bullish and bearish trends. By recognizing and interpreting RSI divergence correctly, traders can enhance their decision-making process and improve their overall trading performance.</p><h3 id="identifying-bullish-trends">Identifying Bullish Trends</h3><p>In order to identify bullish trends, one valuable tool that traders can utilize is RSI divergence. https://www.youtube.com/watch?v=5nM_wypL6YI&t=2s&ab_channel=ArtofForexTrading%21 (RSI) is a widely used indicator that provides insights into the strength and momentum of a particular asset's price movement. By analyzing the RSI, traders can identify potential bullish trends and make informed trading decisions.</p><p>When it comes to RSI divergence, one key aspect to consider is the relationship between the RSI and the price of an asset. During bullish trends, the RSI usually displays a pattern of higher lows, indicating increasing strength and positive momentum. Traders can watch for this divergence between the RSI and price to confirm bullish trends and look for opportunities to enter or stay in a trade.</p><p>Another important factor to consider when identifying bullish trends is the RSI's overbought and oversold levels. The RSI typically ranges from 0 to 100, with readings above 70 signaling overbought conditions and readings below 30 indicating oversold conditions. During bullish trends, the RSI may consistently stay above the oversold level of 30, further confirming the strength of the upward price movement.</p><p>By paying close attention to RSI divergence and the relationship between the RSI and price, traders can effectively identify and capitalize on bullish trends in the market. However, it's essential to note that RSI divergence should not be used as the sole indicator for making trading decisions. It is always recommended to combine it with other technical analysis tools and indicators for a more comprehensive view of market trends.</p><h3 id="spotting-bearish-trends">Spotting Bearish Trends</h3><p>In the world of financial markets, being able to spot bearish trends is crucial for savvy traders. Market participants strive to identify signals that signal a potential downward trend in prices. One powerful tool that can aid in this process is RSI divergence.</p><p>RSI divergence, or Relative Strength Index divergence, occurs when the price of an asset moves in the opposite direction of the RSI indicator. This can indicate a weakening trend and potentially foreshadow a bearish reversal. Traders who are vigilant in monitoring RSI divergence can gain valuable insights into the market sentiment.</p><p>The Relative Strength Index (RSI) is a widely used technical indicator that measures the strength and momentum of a price trend. When the RSI diverges from the price action, it suggests a potential shift in sentiment. This can be observed when the price of an asset continues to rise while the RSI starts to decline, signaling a bearish divergence.</p><p>By paying attention to this bearish RSI divergence, traders can gain insight into potential future price movements. It is important to note that RSI divergence alone should not be the sole basis for making trading decisions. However, when combined with other technical analysis tools and market context, it can provide valuable information to traders.</p><p>In conclusion, spotting bearish trends is a skill that traders should strive to master. RSI divergence is an effective tool in this quest, as it can provide early indications of potential bearish reversals. By incorporating RSI divergence analysis into their trading strategies, market participants can enhance their decision-making process and potentially capitalize on downward price movements.</p>

![[PukiWiki] [PukiWiki]](image/pukiwiki.png)