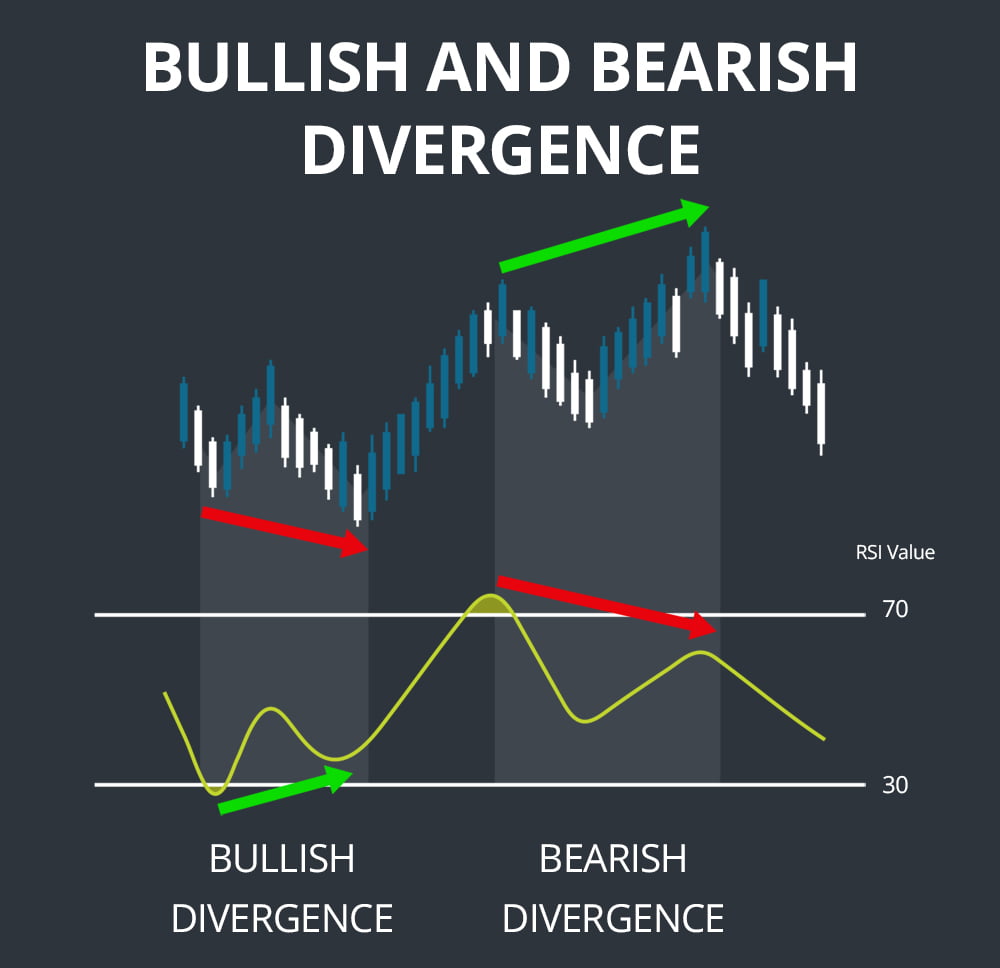

img width="336" src=" "><p>The Relative Strength Index (RSI) is a widely used technical indicator in the world of trading and investing. It measures the momentum of price movements and helps traders identify potential bullish and bearish trends. Understanding RSI divergence can be a powerful tool for spotting these trends and making informed trading decisions.</p><p>RSI divergence occurs when there is a disagreement between the movement of the price and the RSI indicator. In other words, when the price is making higher highs or lower lows while the RSI is making lower highs or higher lows, respectively. This can indicate a potential reversal in the trend and serve as a signal for traders.</p><p>Bullish RSI divergence typically occurs when the price of an asset is trending downwards, but the RSI indicator is showing signs of upward momentum. This can suggest that the selling pressure is weakening, and a bullish reversal may be imminent. On the other hand, bearish RSI divergence occurs when the price is trending upwards, but the RSI is showing signs of downward momentum. This can indicate that the buying momentum is weakening, and a bearish reversal may be on the horizon.</p><p>By recognizing and understanding RSI divergence, traders can gain valuable insight into the strength of a trend and potentially spot profitable trading opportunities. Whether you are a novice trader or an experienced investor, unlocking the power of RSI divergence can provide a valuable edge in navigating the dynamic world of financial markets.</p><h3 id="understanding-rsi-divergence">Understanding RSI Divergence</h3><p>RSI divergence is a powerful tool used by traders to identify potential trend reversals in financial markets. It is based on the Relative Strength Index (RSI), a popular technical indicator that measures the strength and momentum of price movements. By analyzing RSI divergence, traders can gain valuable insights into the underlying bullish or bearish trends.</p><p>When we talk about RSI divergence, we are referring to a situation where the price of an asset and its corresponding RSI indicator are moving in opposite directions. This disparity can indicate a potential shift in the market sentiment, signaling the possibility of a trend reversal. RSI divergence can occur in both bullish and bearish scenarios, providing traders with valuable information for making buy or sell decisions.</p><p>In a bullish RSI divergence, the price of an asset is making lower lows, while the RSI indicator is forming higher lows. This suggests that the selling pressure is weakening, and the potential for a bullish reversal is increasing. Conversely, a bearish RSI divergence occurs when the price is making higher highs, but the RSI indicator is forming lower highs. This indicates weakening buying momentum and a possible bearish reversal.</p><p>By recognizing and understanding RSI divergence, traders can anticipate potential trend changes and adjust their trading strategies accordingly. It is important to note that RSI divergence should not be used as a standalone indicator but rather in conjunction with other technical analysis tools to confirm trading decisions.</p><p>Overall, RSI divergence is a valuable concept that allows traders to spot bullish and bearish trends in the market. By paying attention to the disparity between price movements and RSI indicators, traders can enhance their ability to identify potential trend reversals and make more informed trading choices.</p><h3 id="id"></h3><iframe src="https://www.youtube.com/embed/5nM_wypL6YI" width="560" height="315" frameborder="0" allowfullscreen></iframe><h3 id="identifying-bullish-trends-with-rsi-divergence">Identifying https://www.youtube.com/watch?v=5nM_wypL6YI&t=2s&ab_channel=ArtofForexTrading%21 with RSI Divergence</h3><p>When it comes to recognizing bullish trends in the market, RSI divergence can be a powerful tool. The Relative Strength Index (RSI) is a commonly used technical indicator that tracks price momentum and helps traders identify overbought or oversold conditions. By looking for RSI divergence, we can gain insights into potential bullish trends.</p><p>RSI divergence occurs when the price of an asset moves in the opposite direction of the RSI indicator. In other words, while the price is making lower lows, the RSI is making higher lows. This can indicate a shift in momentum and a potential upcoming bullish trend. Traders often interpret this as a buy signal, suggesting that the price may soon start to rise.</p><p>To spot RSI divergence, we need to compare the price action with the RSI readings. By analyzing charts and observing the relationship between the two, we can identify instances where price and RSI are moving in different directions. This can be a valuable confirmation for traders who are looking to enter the market and capitalize on potential bullish trends.</p><p>It's important to note that RSI divergence is just one tool among many that traders use to analyze market trends. It should be used in conjunction with other technical indicators and fundamental analysis to make well-informed trading decisions. By combining different tools and techniques, traders can increase their chances of success in spotting bullish trends and maximizing their profits.</p><h3 id="spotting-bearish-trends-with-rsi-divergence">Spotting Bearish Trends with RSI Divergence</h3><p>When it comes to identifying bearish trends in the market, RSI divergence can be a powerful tool. The Relative Strength Index (RSI) is a popular momentum oscillator that measures the speed and change of price movements. By analyzing RSI divergence, traders can gain insights into potential reversals in bearish trends.</p><p>One way to spot bearish trends with RSI divergence is by looking for a bearish divergence pattern. This occurs when the price of an asset is making higher highs, but the RSI indicator is making lower highs. It suggests that although the price is rising, the underlying momentum is weakening, indicating a potential reversal in the bearish trend.</p><p>Another technique for spotting bearish trends is by analyzing the RSI trendline. If the RSI is consistently trending downward, it indicates a strengthening bearish trend. This is especially significant when the price of the asset is making lower lows at the same time, reinforcing the bearish signal.</p><p>Additionally, traders can use RSI levels to identify bearish trends. When the RSI is overbought (typically above 70), it suggests that the price of the asset has reached a potentially unsustainable level and a bearish reversal may be imminent. This can be reinforced if the price is also facing resistance or showing signs of weakness.</p><p>In conclusion, RSI divergence can be a valuable tool for traders to spot bearish trends in the market. By paying attention to bearish divergence patterns, analyzing RSI trendlines, and considering overbought RSI levels, traders can improve their ability to identify potential reversals in bearish trends.</p>

"><p>The Relative Strength Index (RSI) is a widely used technical indicator in the world of trading and investing. It measures the momentum of price movements and helps traders identify potential bullish and bearish trends. Understanding RSI divergence can be a powerful tool for spotting these trends and making informed trading decisions.</p><p>RSI divergence occurs when there is a disagreement between the movement of the price and the RSI indicator. In other words, when the price is making higher highs or lower lows while the RSI is making lower highs or higher lows, respectively. This can indicate a potential reversal in the trend and serve as a signal for traders.</p><p>Bullish RSI divergence typically occurs when the price of an asset is trending downwards, but the RSI indicator is showing signs of upward momentum. This can suggest that the selling pressure is weakening, and a bullish reversal may be imminent. On the other hand, bearish RSI divergence occurs when the price is trending upwards, but the RSI is showing signs of downward momentum. This can indicate that the buying momentum is weakening, and a bearish reversal may be on the horizon.</p><p>By recognizing and understanding RSI divergence, traders can gain valuable insight into the strength of a trend and potentially spot profitable trading opportunities. Whether you are a novice trader or an experienced investor, unlocking the power of RSI divergence can provide a valuable edge in navigating the dynamic world of financial markets.</p><h3 id="understanding-rsi-divergence">Understanding RSI Divergence</h3><p>RSI divergence is a powerful tool used by traders to identify potential trend reversals in financial markets. It is based on the Relative Strength Index (RSI), a popular technical indicator that measures the strength and momentum of price movements. By analyzing RSI divergence, traders can gain valuable insights into the underlying bullish or bearish trends.</p><p>When we talk about RSI divergence, we are referring to a situation where the price of an asset and its corresponding RSI indicator are moving in opposite directions. This disparity can indicate a potential shift in the market sentiment, signaling the possibility of a trend reversal. RSI divergence can occur in both bullish and bearish scenarios, providing traders with valuable information for making buy or sell decisions.</p><p>In a bullish RSI divergence, the price of an asset is making lower lows, while the RSI indicator is forming higher lows. This suggests that the selling pressure is weakening, and the potential for a bullish reversal is increasing. Conversely, a bearish RSI divergence occurs when the price is making higher highs, but the RSI indicator is forming lower highs. This indicates weakening buying momentum and a possible bearish reversal.</p><p>By recognizing and understanding RSI divergence, traders can anticipate potential trend changes and adjust their trading strategies accordingly. It is important to note that RSI divergence should not be used as a standalone indicator but rather in conjunction with other technical analysis tools to confirm trading decisions.</p><p>Overall, RSI divergence is a valuable concept that allows traders to spot bullish and bearish trends in the market. By paying attention to the disparity between price movements and RSI indicators, traders can enhance their ability to identify potential trend reversals and make more informed trading choices.</p><h3 id="id"></h3><iframe src="https://www.youtube.com/embed/5nM_wypL6YI" width="560" height="315" frameborder="0" allowfullscreen></iframe><h3 id="identifying-bullish-trends-with-rsi-divergence">Identifying https://www.youtube.com/watch?v=5nM_wypL6YI&t=2s&ab_channel=ArtofForexTrading%21 with RSI Divergence</h3><p>When it comes to recognizing bullish trends in the market, RSI divergence can be a powerful tool. The Relative Strength Index (RSI) is a commonly used technical indicator that tracks price momentum and helps traders identify overbought or oversold conditions. By looking for RSI divergence, we can gain insights into potential bullish trends.</p><p>RSI divergence occurs when the price of an asset moves in the opposite direction of the RSI indicator. In other words, while the price is making lower lows, the RSI is making higher lows. This can indicate a shift in momentum and a potential upcoming bullish trend. Traders often interpret this as a buy signal, suggesting that the price may soon start to rise.</p><p>To spot RSI divergence, we need to compare the price action with the RSI readings. By analyzing charts and observing the relationship between the two, we can identify instances where price and RSI are moving in different directions. This can be a valuable confirmation for traders who are looking to enter the market and capitalize on potential bullish trends.</p><p>It's important to note that RSI divergence is just one tool among many that traders use to analyze market trends. It should be used in conjunction with other technical indicators and fundamental analysis to make well-informed trading decisions. By combining different tools and techniques, traders can increase their chances of success in spotting bullish trends and maximizing their profits.</p><h3 id="spotting-bearish-trends-with-rsi-divergence">Spotting Bearish Trends with RSI Divergence</h3><p>When it comes to identifying bearish trends in the market, RSI divergence can be a powerful tool. The Relative Strength Index (RSI) is a popular momentum oscillator that measures the speed and change of price movements. By analyzing RSI divergence, traders can gain insights into potential reversals in bearish trends.</p><p>One way to spot bearish trends with RSI divergence is by looking for a bearish divergence pattern. This occurs when the price of an asset is making higher highs, but the RSI indicator is making lower highs. It suggests that although the price is rising, the underlying momentum is weakening, indicating a potential reversal in the bearish trend.</p><p>Another technique for spotting bearish trends is by analyzing the RSI trendline. If the RSI is consistently trending downward, it indicates a strengthening bearish trend. This is especially significant when the price of the asset is making lower lows at the same time, reinforcing the bearish signal.</p><p>Additionally, traders can use RSI levels to identify bearish trends. When the RSI is overbought (typically above 70), it suggests that the price of the asset has reached a potentially unsustainable level and a bearish reversal may be imminent. This can be reinforced if the price is also facing resistance or showing signs of weakness.</p><p>In conclusion, RSI divergence can be a valuable tool for traders to spot bearish trends in the market. By paying attention to bearish divergence patterns, analyzing RSI trendlines, and considering overbought RSI levels, traders can improve their ability to identify potential reversals in bearish trends.</p>

![[PukiWiki] [PukiWiki]](image/pukiwiki.png)